3 Tax Buckets

𝗗𝗼𝗻'𝘁 𝗽𝘂𝘁 𝗮𝗹𝗹 𝘆𝗼𝘂𝗿 𝗲𝗴𝗴𝘀 𝗶𝗻 𝗼𝗻𝗲 𝗯𝗮𝘀𝗸𝗲𝘁.

When you hear about "diversifying your dollars" most people immediately think about investment options.

Ensure your investments are diversified by:

Assets classes

Market cap

Industries

Locations

Etc.

𝗕𝘂𝘁 𝗱𝗶𝘃𝗲𝗿𝘀𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻 𝗮𝗹𝘀𝗼 𝗮𝗽𝗽𝗹𝗶𝗲𝘀 𝘁𝗼 𝘁𝗮𝘅𝗲𝘀.

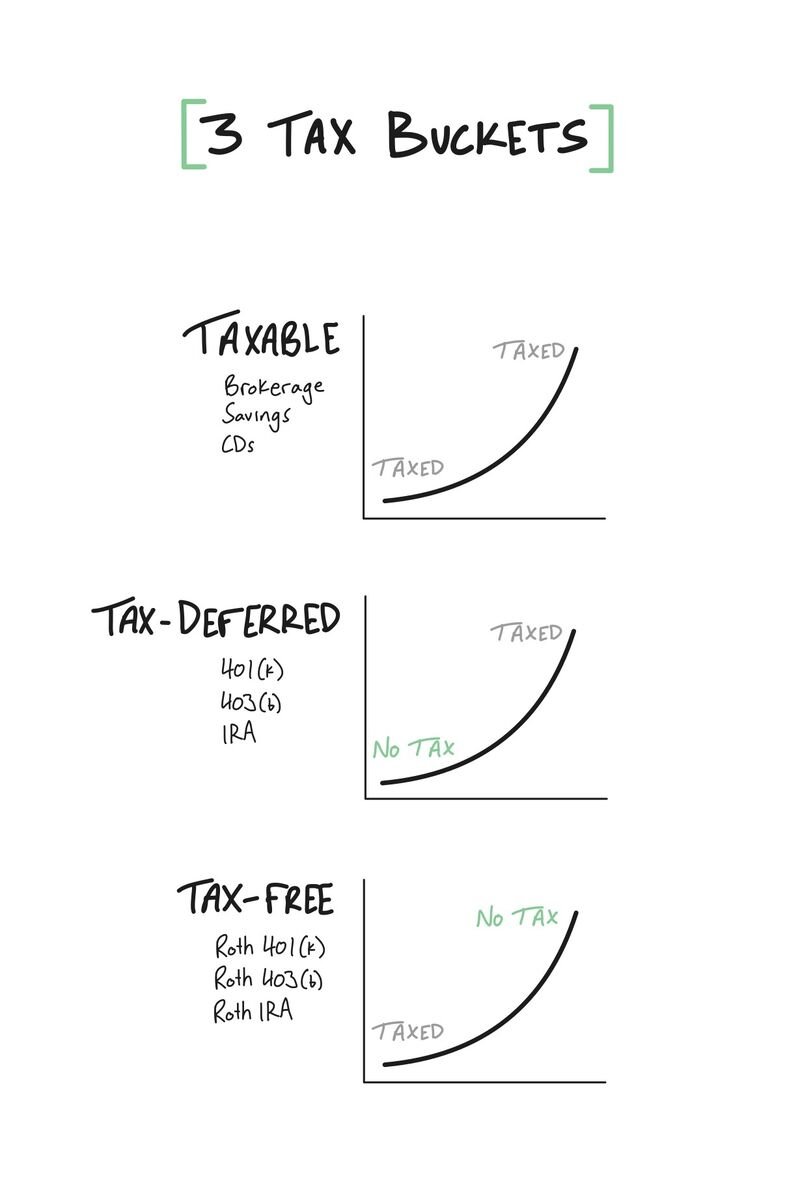

All investment accounts are subject to 1 of 3 tax treatments.

All three have varying levels of flexibility and benefits.

Depending on your income, age, location, and risk tolerance, it's important to strategize how much you have in each tax bucket.

Here’s a graph to help visualize:

Year End Tax Savings Tips

It's that time of year when I open my email and there are a handful of questions asking about last-minute tax-savings strategies.

By mid-December, it's too late to do in-depth tax planning.

But there are a few simple tax-saving strategies many taxpayers can still take advantage of:

1️⃣ 𝗠𝗮𝘅 𝗢𝘂𝘁 𝗛𝗦𝗔

With triple tax savings, the HSA is the most tax-advantaged account out there. Annual contribution limits are $4,150 for self-only and $8,300 for families in 2024. If you're 55 or older, you can contribute an additional $1,000 as a catch-up.

2️⃣ 𝗧𝗮𝘅 𝗟𝗼𝘀𝘀 𝗛𝗮𝗿𝘃𝗲𝘀𝘁

Within your taxable investment accounts, you can offset gains by selling investments at a loss and reducing your taxable income by up to $3,000. Any excess losses can be carried forward to future years. This is a bit more advanced, so plan appropriately.

3️⃣ 𝗖𝗼𝗻𝘁𝗿𝗶𝗯𝘂𝘁𝗲 𝘁𝗼 𝗮 𝟱𝟮𝟵 𝗣𝗹𝗮𝗻

Contributions to a 529 college savings plan can offer state income tax deductions (depending on your state). The dollars grow and are withdrawn tax-free when used for qualified education expenses.

4️⃣ 𝗜𝗻𝗰𝗼𝗺𝗲 𝗮𝗻𝗱 𝗘𝘅𝗽𝗲𝗻𝘀𝗲 𝗦𝗵𝗶𝗳𝘁𝗶𝗻𝗴

For business owners, if you expect your tax bracket to increase next year, you can strategize these last few weeks by accelerating income into 2024 and deferring expenses into 2025. This allows you to push more taxable dollars into the year of your lower tax rate.

5️⃣ 𝗠𝗮𝘅 𝗢𝘂𝘁 𝗥𝗲𝘁𝗶𝗿𝗲𝗺𝗲𝗻𝘁 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝘀

Max out contributions to retirement accounts like a 401(k) or IRA to reduce your taxable income. The 2024 contribution limit for 401(k) plans is $23,000 ($30,000 if 50 or older) and $7,000 for IRAs ($8,500 if 50 or older).

6️⃣ 𝗠𝗮𝗸𝗲 𝗮 𝗖𝗵𝗮𝗿𝗶𝘁𝗮𝗯𝗹𝗲 𝗖𝗼𝗻𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻

Donations to qualified charitable organizations are tax-deductible (for those who itemize). You can either make cash donations directly to an organization, or you can contribute to a Donor Advised Fund (DAF), which allows you to take the tax deduction now, but determine which organization the funds go to in the future.

3 IRS penalties to know about before April 15th

🚫 Underpayment of Estimated Taxes

𝗥𝗲𝗮𝘀𝗼𝗻: You don’t pay taxes evenly throughout the year.

𝗣𝗲𝗻𝗮𝗹𝘁𝘆: Annual interest of 8% on the underpaid amount for the number of days the payment is late.

𝗛𝗼𝘄 𝘁𝗼 𝗔𝘃𝗼𝗶𝗱: Your filed tax return shows you owe less than $1,000 OR You paid at least 90% of the tax shown on the return for the taxable year or 100% (110% for high-income taxpayers) of the tax shown on the return for the prior year, whichever amount is less.

🚫 Failure To Pay

𝗥𝗲𝗮𝘀𝗼𝗻: You don’t pay 100% of taxes owed by April 15th.

𝗣𝗲𝗻𝗮𝗹𝘁𝘆: The failure to pay penalty is 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid. The penalty won’t exceed 25% of your unpaid taxes.

𝗛𝗼𝘄 𝘁𝗼 𝗔𝘃𝗼𝗶𝗱: Pay 100% of taxes owed by April 15th.

🚫 Failure To File

𝗥𝗲𝗮𝘀𝗼𝗻: You don’t file your tax return (or an extension to file) by April 15th.

𝗣𝗲𝗻𝗮𝗹𝘁𝘆: The Failure to File penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won't exceed 25% of your unpaid taxes.

𝗛𝗼𝘄 𝘁𝗼 𝗔𝘃𝗼𝗶𝗱: File your tax return (or an extension to file) by April 15th.

Failure to file penalty should never happen.

Underpayment of estimated taxes likely only happens when you aren't working with a tax pro year-around.

Failure to pay is more common and likely won't hurt if it is just a few months, but don't let it get out of hand!