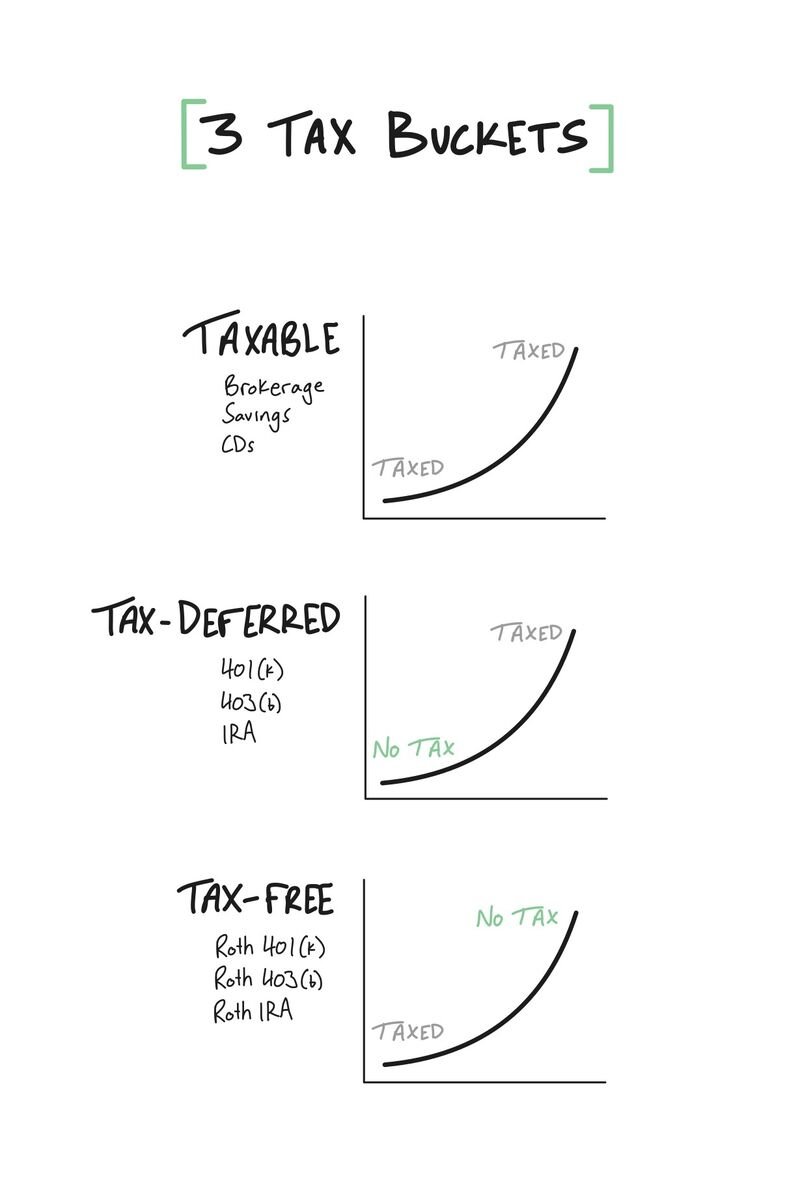

3 Tax Buckets

𝗗𝗼𝗻'𝘁 𝗽𝘂𝘁 𝗮𝗹𝗹 𝘆𝗼𝘂𝗿 𝗲𝗴𝗴𝘀 𝗶𝗻 𝗼𝗻𝗲 𝗯𝗮𝘀𝗸𝗲𝘁.

When you hear about "diversifying your dollars" most people immediately think about investment options.

Ensure your investments are diversified by:

Assets classes

Market cap

Industries

Locations

Etc.

𝗕𝘂𝘁 𝗱𝗶𝘃𝗲𝗿𝘀𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻 𝗮𝗹𝘀𝗼 𝗮𝗽𝗽𝗹𝗶𝗲𝘀 𝘁𝗼 𝘁𝗮𝘅𝗲𝘀.

All investment accounts are subject to 1 of 3 tax treatments.

All three have varying levels of flexibility and benefits.

Depending on your income, age, location, and risk tolerance, it's important to strategize how much you have in each tax bucket.

Here’s a graph to help visualize: